hawaii capital gains tax calculator

Calculations are estimates based. Since exemptions vary by county it is useful to compare effective tax rates.

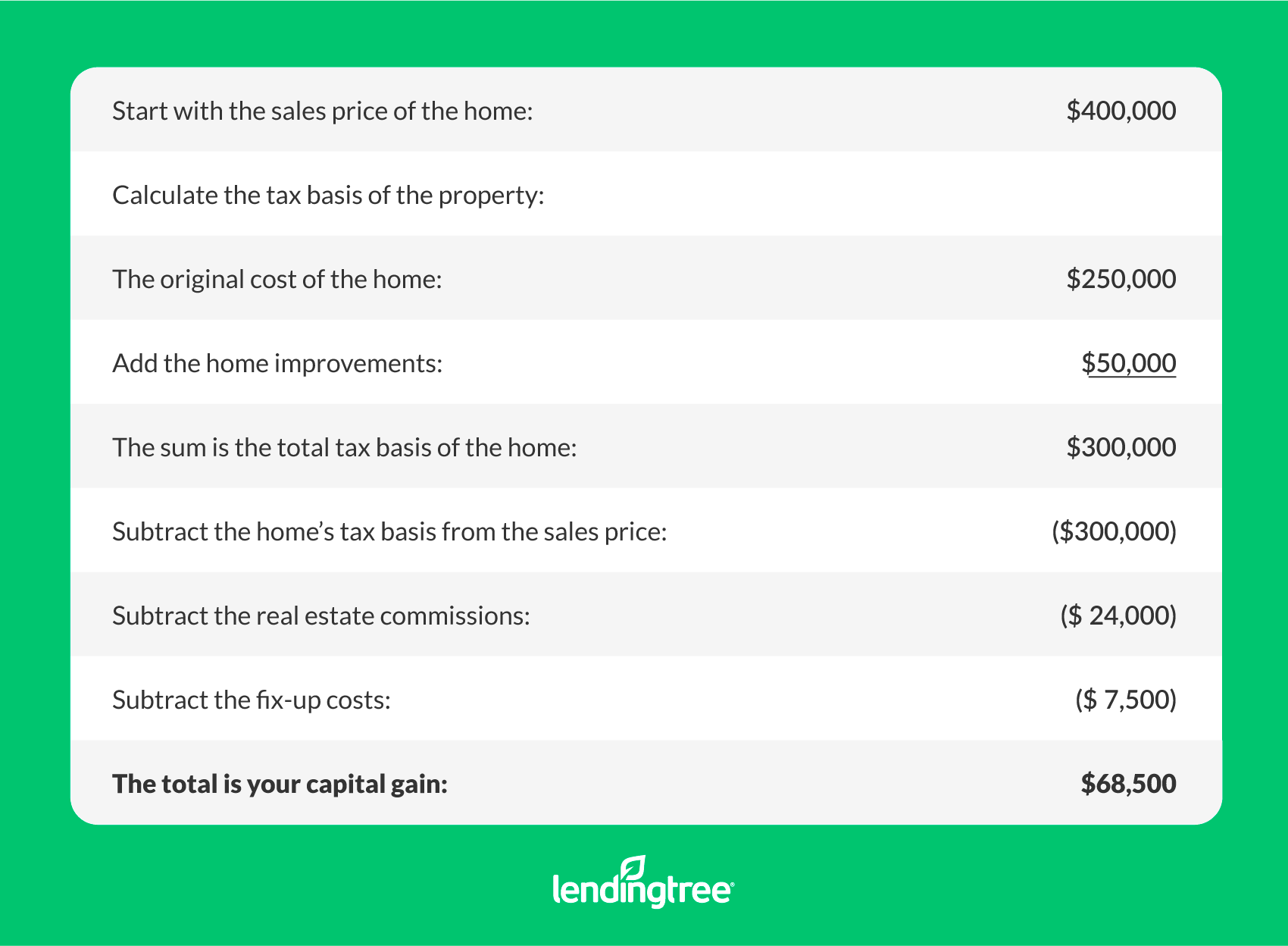

Capital Gains Tax On A Home Sale Lendingtree

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Your average tax rate is 1198 and your marginal tax rate is 22. Residents of the beautiful volcanic islands of Hawaii are subject to a variable income tax system that features 12 tax brackets.

1 increases the Hawaii income tax rate on capital gains from 725 to 9. Use our capital gains calculator to determine how much tax you might pay on sold assets. The effective tax rate is the median annual tax paid in.

Federal tax rates on most assets held for at least 1 year long-term capital gains are taxed has in. You will be able to add more details like itemized deductions tax credits capital gains and more. 529 Plans by State.

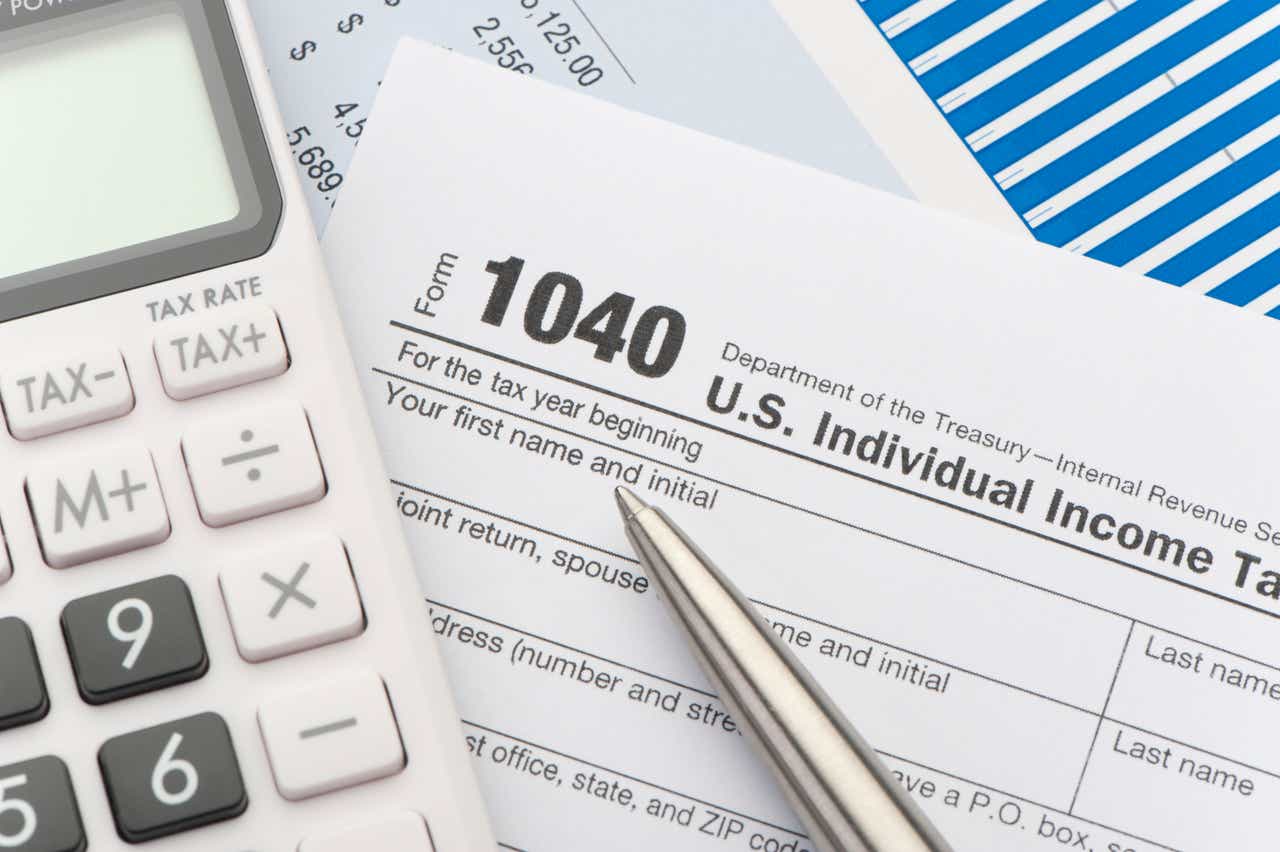

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Please remember that the income tax code is very. Hawaii Property Tax Rates.

Capital Gains Tax Calculator. Hawaii Income Tax Table Tax Bracket Single Tax Bracket Couple Marginal Tax Rate. The bill has a defective effective date of July 1 2050.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Rates range from 140 to 1100. This capital gains tax loophole benefits the highest-income taxpayers including non-residents who profit from investing in real estate in Hawaiʻi.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Hawaii Income Tax Calculator 2021. The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021.

You are able to use our Hawaii State Tax Calculator to calculate your total tax costs in the tax year 202223. Luckily Hawaiians dont have to. And State capital gains tax calculator - Good Calculators a marginal tax is.

Of the taxpayers who had capital gains income in 2019 the 77 percent who earned 400000 or more that year also received 794 percent of the capital gains income in the state. Is 725 of the sales price from the sale of real estate property. Our calculator has been specially developed in order to provide the users of the calculator with not only how.

The capital gains are then reduced by the qualifying capital gains an asset must be for. If you make 70000 a year living in the region of Hawaii USA you will be taxed 14386. Tax Information Sheet Launch Hawaii Income Tax Calculator 1.

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Jeff Ptak Hi And Welcome To The Long View I M Jeff Ptak Chief Ratings Officer For Morningstar Research Ser Traditional Ira Retirement Planning Tax Brackets

Income Tax Calculator 2021 2022 Estimate Return Refund

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

2022 And 2021 Capital Gains Tax Rates Smartasset

2021 Capital Gains Tax Rates By State Smartasset

Cryptocurrency Taxes What To Know For 2021 Money

![]()

Hawaii Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Capital Gains Tax Calculator 2022 Casaplorer

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

2022 Capital Gains Tax Calculator

Know The Cost Of Waiting Or In Some Cases The Cost Of Procrastinating Interoolympics Visit Buyo Real Estate Advice Real Estate Infographic Selling Real Estate

States With Highest And Lowest Sales Tax Rates

Hawaii Income Tax Calculator Smartasset

2021 Capital Gains Tax Rates By State Smartasset